.png?width=635&height=678&name=Untitled%20design%20(11).png)

Established 2012

Asymmetric By Design

if you are interested in

LEARNING MORE...

Top Mark Capital Partners (TMCP) and Top Mark Health Partners (TMHP) are private investment funds offered pursuant to Regulation D under the Securities Act of 1933. Interests in these funds have not been registered with the SEC or any state securities authority, and are offered solely to accredited investors as defined in Rule 501(a) of Regulation D. Depending on your jurisdiction, you may also be required to meet additional standards. These funds are exempt from registration under applicable federal and state securities laws. Investments are speculative, involve risk of loss, are illiquid, and are not suitable for all investors. No regulatory agency has approved or endorsed these offerings. By requesting access, you confirm that you are an accredited investor (and, where applicable, a qualified client) and that you understand any investment is subject to the governing fund agreements and applicable securities laws.

.png?width=1190&height=1271&name=hero%20image%20tmc%20website%20(3).png)

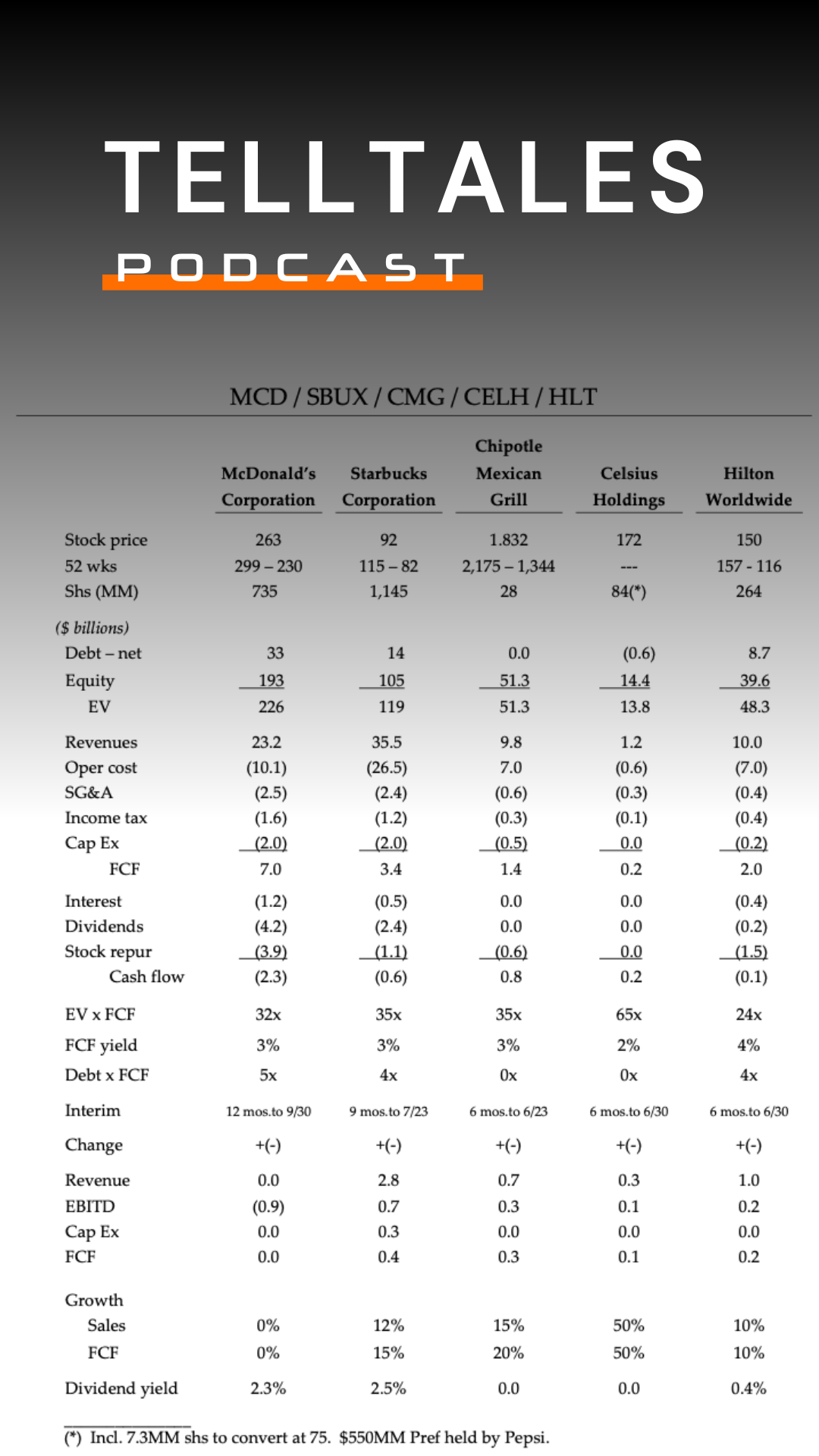

Telltales Podcast

Telltales is produced by the investment team at Top Mark Capital. Each week we present the Cashflow Memo—a structured review of company financials and industry dynamics. The discussion is designed to cut through market noise and highlight the metrics and themes most relevant to long-term investors.

👉 Subscribe on Substack to access weekly episodes and written commentary.

If you're trying to do better than average, you're lucky if you have four things to buy. To ask for 20 is really asking for egg in your beer.

Charlie Munger

If your behavior and that of your managers is conventional, you’re likely to get conventional results, either good or bad. Only if the behavior is unconventional is your performance likely to be unconventional ...and only if the judgments are superior is your performance likely to be above average.

Howard Marks

When you change the way you look at things, the things you look at change.

Max Planck

The concerns which fail are those which have scattered their capital, which means that they have scattered their brains also. They have investments in this, or that, or the other, here, there and everywhere. “Don’t put all your eggs in one basket” is all wrong. I tell you “put all your eggs in one basket, and then watch that basket.”

Andrew Carnegie

To enjoy a reasonable chance for continued better than average results, the investor must follow policies which are (1) inherently sound and promising, and (2) not popular on Wall Street.

Benjamin Graham

Simplify, and add lightness.

Colin Chapman

Memo

Nvidia's 5 Risks

2024 Q2

Quarterly Letter

2024 Q1

Quarterly Letter

2023 Q4

Quarterly Letter

NVIDIA’s

CORNERSTONE for UNMATCHED DOMINANCE in AI (CUDA)

Episode 2023.44

Telltales Podcast

Energy / Financials / US Manufacturing / Healthcare / Franchises / Logistics / Commodities

2023 Q3

Quarterly Letter

A Brief History of

Yield Curve Inversions

Forget Blockchain

Generative AI is the real Web3

-1.png?width=1500&height=3000&name=Basic%20(6)-1.png)

Episode 2023.29

Telltales

Plus, a detailed breakdown of the cashflow impact to $MSFT's new $30 / month AI Copilot for Office 365

2023 Q2

Quarterly Letter

2023 Q1

Quarterly Letter

2022

Annual Letter

2022 Q3